31 December 2024

Josh Gardner. CEO @ Kung Fu Data | Building Brands In China, writes on LinkedIn: As an entrepreneur, I get it—taxes can be a real pain. They chip away at hard-earned profits and can sometimes feel like an unnecessary burden.

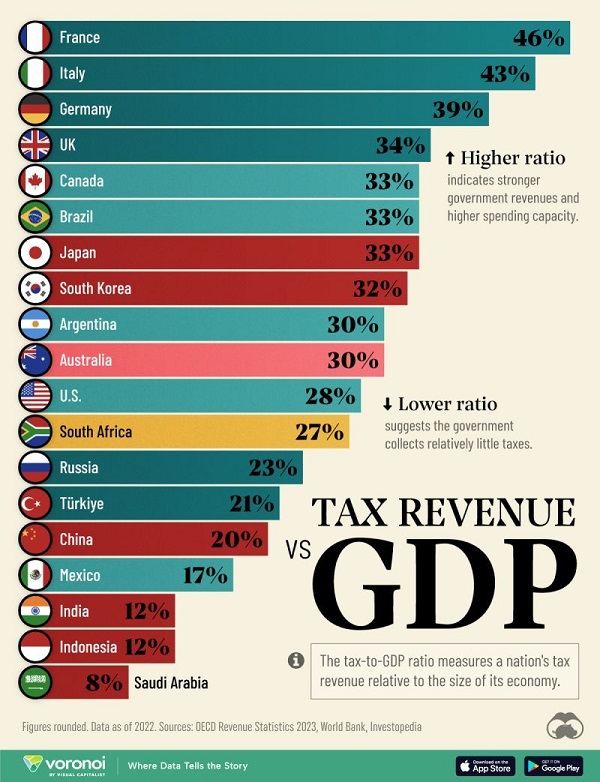

But when you look at the global picture, the tax-to-GDP ratio reveals a lot about a country’s economic health and the environment we’re operating in.

Take Europe, for example.

France, Italy, and Germany top the list in the G20 with tax-to-GDP ratios above 39%. That’s a significant chunk of revenue going back to the government.

While it may sting to hand over so much of what you’ve earned, these high ratios often fund essential public services and infrastructure that indirectly support business growth.

On the flip side, countries like India and Indonesia, with lower tax-to-GDP ratios, might offer a lighter tax load but often have less robust public services.

The challenge is finding that sweet spot where taxes support a healthy economy without stifling entrepreneurial spirit.

While taxes are a necessary part of doing business, understanding where your country stands in the global landscape can help you strategize better for growth.

So, after seeing the numbers… what do you think? Are you paying too much in taxes?

Hat tip to Visual Capitalist for the great graphic

We bring leather, material and fashion businesses together: an opportunity to meet and greet face to face. We bring them from all parts of the world so that they can find fresh partners, discover new customers or suppliers and keep ahead of industry developments.

We organise a number of trade exhibitions which focus on fashion and lifestyle: sectors that are constantly in flux, so visitors and exhibitors alike need to be constantly aware both of the changes around them and those forecast for coming seasons.